Carbon Pricing: A Key Driver of Climate Change Mitigation

Last week, In a lecture to students at Georgetown University in Washington, D.C., World Bank Group President Jim Yong Kim spoke about the main drivers of climate change, and how these can be addressed.

“We have to keep the economy growing – there is no turning back on growth… What we have to do is decouple growth from carbon emissions.” (Kim)

The first step he proposed was by creating a method to price carbon Emissions.

According the the World Bank, carbon pricing captures “what are known as the external costs of carbon emissions”. These are the costs that the public and community pays for indirectly. Driving a car, buying take-out food with tons of packaging, using plastic bottled water, etc doesn’t “seem” to be harmful, or “generate” carbon emissions but it does. The emissions are generated upstream while it is being manufactured. Carbon Pricing seeks to connect the impact of these external sources via putting a price on carbon.

“A price on carbon is the single most important thing we have to get out of a Paris agreement. It will unleash market forces” (Kim)

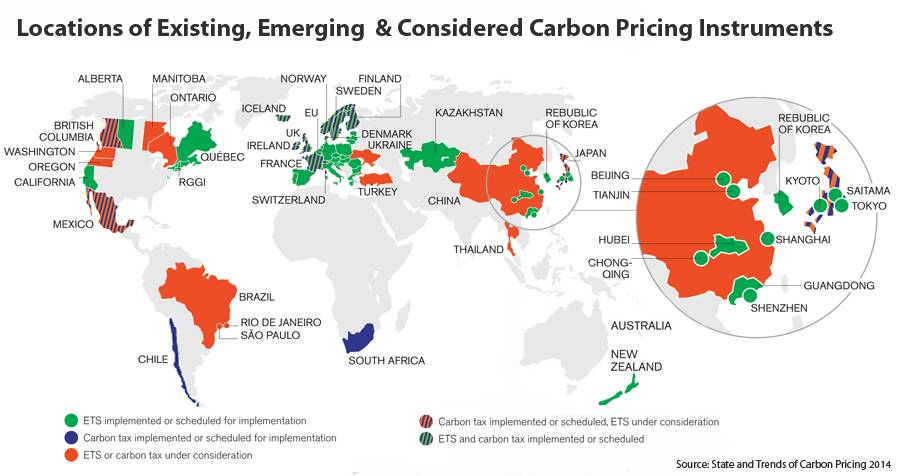

There are generally two approaches to Pricing Carbon. The first is known as Carbon Cap and Trade, the second a Carbon Tax. In a Cap-and-Trade system, the total level of greenhouse gas emissions for the region is set, and allows those industries with low emissions to sell their extra allowances to larger emitters. By creating a market condition (supply and demand) for emissions allowances, a market price for greenhouse gas emissions is determined by the businesses. The cap ensure the required emission reduction take place to keep the entire region within its target.

On the other hand, a Carbon Tax sets a price on carbon (usually by the ton — In BC it is $30). By setting a tax rate on emissions or the carbon in fossil fuels it is different from the Cap-Trade system which lets the market determine the pin that the emission reduction outcome of a carbon tax is not pre-defined but the carbon price is. British Columbia is the first province in Canada to implement a Carbon Tax. The BC revenue-neutral carbon tax was implemented on July 1, 2008. The carbon tax is revenue neutral, meaning every dollar generated by the tax is returned to British Columbians through reductions in other taxes.

The tax puts a price on carbon to encourage individuals, businesses, industry and others to use less fossil fuel and reduce their greenhouse gas emissions; send a consistent price signal; ensure those who produce emissions pay for them; and make clean energy alternatives more attractive (link)

The advantage of a Carbon Tax is that it provides an incentive to reduce emissions without favouring any particular method: allowing stakeholders to find the solution which works best for them. By reducing consumption, increasing efficiency, and using cleaner energy sources, businesses and individuals can reduce the amount they pay in carbon tax, or even offset it altogether.

The remainder of World Bank Group President Jim Yong Ki’s summary of the key drivers of climate change, and how these can be addressed can be found here.